When building financial applications, loan calculators are a must-have tool. They allow users to see monthly installments, total repayment amounts, interest costs and more. But what if we flip the perspective? Instead of calculating the installment based on the requested loan amount, what if a customer knows how much they want to repay monthly and the total cost they are willing to bear?

Let’s walk through a practical implementation of how to reverse-calculate the loan principal based on:

The monthly installment amount

Total payment amount

Installment term (in months)

Applicable interest rates and fees

This is especially useful for customers planning their budgets strictly around monthly affordability.

📌 Problem Statement

You already have a method that calculates the installment and total repayment based on a requested loan amount:

public CreditCalculationModel CalculateMonthlyAmount(

double total, int installment, double taxKkdf, double taxBsmv,

double feeAppraisal, double feeMortgage)

Now, you want to do the reverse:

➡️ Given installment, totalPaymentAmount and fee/tax settings, determine the CreditAmount (i.e. the loan principal).

📊 Required Parameters

To compute this, we need the following:

installment: Loan term in monthstotalPaymentAmount: How much the borrower will pay in totaltaxKkdfandtaxBsmv: Additional financial taxes (percentages)feeAppraisalandfeeMortgage: Fixed fees applied to the loanInterestandFee: Configurable values from your credit product

🧠 Understanding the Math

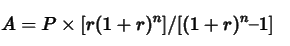

Let’s break down the formula for monthly installment calculation first:

Where:

A= Monthly installmentP= Loan amountr= Monthly interest rate (adjusted with tax)n= Number of installments

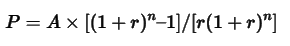

To reverse the formula, we isolate P:

We calculate A from:

monthlyInstallment = (totalPaymentAmount - feeAppraisal - feeMortgage - feePaid) / installment

Where feePaid = CreditAmount * FeeRate

But since CreditAmount is what we want to find, we use iterative estimation (or symbolic isolation) or we approximate by:

CreditAmount = (approximate)

But since our case includes a percentage-based fee, we can refine the logic like this.

🛠️ Implementation in C#

public CreditCalculationModel CalculateLoanAmount(

int installment, double totalPaymentAmount,

double taxKkdf, double taxBsmv,

double feeAppraisal, double feeMortgage)

{

// Adjust taxes and fees based on credit type

var tax = Type == CreditType.HousingCredit ? 0 : taxKkdf + taxBsmv;

feeAppraisal = Type == CreditType.HousingCredit ? feeAppraisal : 0;

feeMortgage = Type == CreditType.HousingCredit ? feeMortgage : 0;

// Monthly interest rate including tax

var interest = (double)Interest * (1 + (tax / 100)) / 100;

// Use exponent for the number of installments

var us = Math.Pow(1 + interest, installment);

// Estimate the monthly installment (excluding fees)

var installmentWithoutFees = (totalPaymentAmount - feeAppraisal - feeMortgage) / installment;

// Reverse-engineer the loan amount

var creditAmount = installmentWithoutFees * (us - 1) / (interest * us);

// Compute percentage-based fee

var feePaid = creditAmount * (double)Fee / 100;

// Recalculate monthly installment with fees

var finalMonthlyInstallment = (creditAmount * (interest * us) / (us - 1));

// Yearly cost rate (effective interest rate)

var cost = (Math.Pow(1 + interest, 12) - 1) * 100;

return new CreditCalculationModel

{

MonthlyInstallment = finalMonthlyInstallment,

TotalPaymentAmount = totalPaymentAmount,

Interest = Interest,

Fee = feePaid,

CreditAmount = creditAmount,

Installment = installment,

YearlyCostRate = cost

};

}

✅ Output: What You Get

The method returns a structured CreditCalculationModel:

MonthlyInstallment: Recalculated with real interestCreditAmount: The estimated loan principalFee: Percentage-based fee paidYearlyCostRate: The effective annual interest rate

📈 Real-World Use Case

This method is perfect for scenarios like:

Mortgage planning: “I want to pay ₺20,000/month for 120 months. How much loan can I get?”

Budget-driven credit advisors

Dynamic loan simulation tools

It provides a customer-centric view of borrowing capacity rather than just system-driven constraints.

🧩 Final Thoughts

Reverse-engineering financial calculations might seem complex at first but with the right formulas and a little math, it becomes a powerful tool in fintech development. By allowing your users to explore scenarios based on total cost and affordability, you empower them with transparency and control, two things modern banking users expect.